UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

| Preliminary Proxy Statement | |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement | |

o | | Definitive Additional Materials |

o | | Soliciting Material under §240.14a-12 |

| ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG | ||||

(Exact name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | | No fee required. | ||

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| | (1) | | Title of each class of securities to which transaction applies: | |

| | (2) | | Aggregate number of securities to which transaction applies: | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | (4) | | Proposed maximum aggregate value of transaction: | |

| | (5) | | Total fee paid: | |

o | | Fee paid previously with preliminary materials. | ||

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | | Amount Previously Paid: | |

| | (2) | | Form, Schedule or Registration Statement No.: | |

| | (3) | | Filing Party: | |

| | (4) | | Date Filed: | |

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION — DATED FEBRUARY 22, 2017Table of Contents

![]()

ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AGPark Tower, 15th floor, Gubelstrasse 246300 Zug, Switzerland

February 22, 2017

Dear Shareholder:

We are pleased to invite you to attend the extraordinary general meeting of shareholders of Allied World Assurance Company Holdings, AG (“Allied World,” the “company,” “we,” “our” or “us”), a Swiss corporation, which will be held at Allied World’s corporate headquarters, Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland, on March 22, 2017, at 2:00 p.m., local time (the “Special Shareholder Meeting”).

The Special Shareholder Meeting is being called to vote on the items described below in connection with the proposed exchange offer (the “offer”) by a wholly-owned subsidiary (“Bid Sub”) of Fairfax Financial Holdings Limited, a corporation existing under the laws of Canada (“Fairfax”), to acquire all of the outstanding common shares, par value CHF 4.10 per share of Allied World (“common shares”), pursuant to the terms, and subject to the conditions, of that certain Agreement and Plan of Merger, dated as of December 18, 2016, between Fairfax and Allied World, as may be amended from time to time.

At the Special Shareholder Meeting, holders of our common shares will be asked to consider and vote on: (i) a proposal to amend Articles 8 and 14 of the company’s Articles of Association to remove the limitation on the voting rights of a holder of 10% or more of our common shares (the “Amendment Proposal”); and (ii) a proposal for Allied World to pay, as soon as possible after the closing of the offer, a special dividend of $5.00 per common share to holders of our outstanding common shares as of immediately prior to the closing of the offer and to forgo the $0.26 quarterly dividend (the “Special Dividend Proposal”). Each proposal is conditioned on the closing of the offer.

The Board unanimously recommends that the shareholders of the company vote FOR the Amendment Proposal and vote FOR the Special Dividend Proposal.

Completion of the offer is conditioned on, among other things, the approval of each of these proposals. Please note that by voting on these proposals, you are not making a decision with respect to the offer. You will have the opportunity to elect whether to tender your shares in the offer at a later date once the offer is commenced. See “Important Note Regarding the Special Shareholder Meeting.”

Your vote is very important. Whether or not you expect to attend in person, we urge you to submit a proxy to vote your shares as promptly as possible by signing and returning the enclosed proxy card in the postage-paid envelope provided, so that your shares may be represented and voted at the Special Shareholder Meeting. If your shares are held in an Allied World plan or in the name of a bank, brokerage firm or other nominee, please follow the instructions on the voting instruction card furnished by the plan trustee or administrator, or record holder, as appropriate.

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor, Georgeson LLC, at (800) 248-7690.

Thank you for your continued support.

![]()

| ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG NOTICE OF ANNUAL SHAREHOLDER MEETING |

February 22,May 26, 2017

| DATE: | | Wednesday, |

| TIME: | | 2:00 p.m., local time |

| PLACE: | | Corporate headquarters: Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland |

ITEMS OF BUSINESS:

| RECORD DATE: | | Only shareholders of record holding common shares, as shown on our transfer books, as of the close of business on |

MATERIALS TO REVIEW: | | This document contains our Notice of |

PROXY VOTING: | | It is important that your shares be represented and voted at the |

| | By Order of the Board of Directors, | |

| |  | |

| | Theodore Neos Corporate Secretary |

TABLE OF CONTENTS

-i-

WhileAlthough the market environment for insurers and reinsurers remained challenging, we continued to develop as a global specialty insurer with disciplined underwriting and a focused build-out of product capabilities. In North America, we further increased scale and penetration in our specialty casualty and property lines with a broad range of product offerings that drove our profitability. In our Global Markets Insurance segment, we successfully integrated our recent acquisitions in Hong Kong and Singapore and upgraded the infrastructure in the region to better position our Asian platform for profitable opportunities. We were also successful in implementing group-wide cost-saving initiatives.

In 2016, we generated net income of $255.3 million and our year-end diluted book value per share was $39.52, a 4.6% increase for the year. Our combined ratio was 96.2% and underwriting performance benefitted from profitable growth across our insurance and reinsurance businesses. Favorable reserve releases of $98.3 million, total return on the company’s investment portfolio of $219.9 million and successful management of expenses combined to contribute to our performance.

On December 18, 2016, we entered into a merger agreement with Fairfax Financial Holdings Limited (“Fairfax”), whereby Fairfax will acquire all of our outstanding common shares. Under the terms of the merger agreement, our shareholders will receive a combination of Fairfax subordinate voting shares and cash having a value equal to $54.00 per share (based on the closing price of Fairfax’s subordinate voting shares on December 16, 2016). The merger agreement has been unanimously approved by both companies’ Boards of Directors. The acquisition is expected to be consummated following the satisfaction of customary closing conditions.

-1-

| Financial Performance |

The following table contains key financial data for each of the offerlast three fiscal years, including data as of each year end.

Operating Results | | 2016 | | 2015 | | 2014 | | |||

|---|---|---|---|---|---|---|---|---|---|---|

| | | ($ in millions, except share, per share and percentage data) | | |||||||

Total Assets | | $ | 13,179 | | $ | 13,512 | | $ | 12,419 | |

Total Debt and Other Liabilities | | $ | 9,627 | | $ | 9,979 | | $ | 8,641 | |

Total Shareholders’ Equity | | $ | 3,552 | | $ | 3,533 | | $ | 3,778 | |

Diluted Book Value per Share | | $ | 39.52 | | $ | 37.78 | | $ | 38.27 | |

Increase/(Decrease) in Diluted Book Value per Share | | 4.6% | | (1.3 | )% | 11.9% | | |||

Gross Premiums Written | | $ | 3,066 | | $ | 3,093 | | $ | 2,935 | |

Net Income | | $ | 255 | | $ | 84 | | $ | 490 | |

Operating Income | | $ | 239 | | $ | 212 | | $ | 415 | |

Total Return on Investments | | 2.5% | | 0.6% | | 3.1% | | |||

Net Income Return on Average Shareholders’ Equity | | 7.2% | | 2.3% | | 13.4% | | |||

Operating Return on Average Shareholders’ Equity | | 6.7% | | 5.8% | | 11.4% | | |||

Combined Ratio(1) | | 96.2% | | 95.1% | | 85.2% | | |||

Cash Dividends Paid | | $ | 92 | | $ | 114 | | $ | 77 | |

Number of Common Shares Outstanding | | 87,098,120 | | 90,959,635 | | 96,195,482 | | |||

Weighted Average Common Shares Outstanding - Diluted | | 89,800,894 | | 94,174,460 | | 99,591,773 | | |||

Repurchase of Common Shares | | $ | 166 | | $ | 245 | | $ | 175 | |

Detailed information of our financial and operational performance is conditionedcontained in our Annual Report on (among other things) the approvalForm 10-K that is included in our 2016 Annual Report accompanying this Proxy Statement. See our Annual Report on Form 10-K for a reconciliation of the Amendment Proposal andnon-GAAP financial measures included in the Special Dividend table above.

| Company’s Performance Relative to Its Peer Group as of December 31, 2016 (In quartiles. 1=first quartile, the highest level; 4=fourth quartile, the lowest level) |

Performance Metric | | 2016 (one year) Rank | | 2014-2016 (three year) Rank | | 2012-2016 (five year) Rank | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Diluted Book Value per Share Growth (adjusted for dividends) | | | 3 | | | | 3 | | | | 2 | | | |||

Annualized Net Income Return on Average Equity (adjusted for other comprehensive income) | | | 3 | | | | 4 | | | | 2 | | | |||

Combined Ratio | | | 3 | | | | 3 | | | | 2 | | | |||

Total Shareholder Return | | | 1 | | | | 3 | | | | 1 | | | |||

-2-

| Shareholder Voting Recommendations |

Our Board of Directors unanimously makes the following recommendations:

| | Proposal | | Vote Recommendation | | See Page Number for More Information | |

|---|---|---|---|---|---|---|

| Proposal 1 | | Elect the Board of Directors | | FOR EACH NOMINEE | | p. 15 |

Proposal 2 | | Elect the Chairman of the Board of Directors | | FOR | | p. 26 |

Proposal 3 | | Elect the Compensation Committee Members | | FOR EACH NOMINEE | | p. 26 |

Proposal 4 | | Elect the Independent Proxy | | FOR | | p. 27 |

Proposal 5 | | Advisory Vote on 2016 Executive Compensation as Required Under U.S. Securities Laws | | FOR | | p. 27 |

Proposal 6 | | Advisory Vote on Frequency of the Shareholder Vote on Executive Compensation as Required Under U.S. Securities Laws | | EVERY YEAR | | p.28 |

Proposal 7 | | Approve the 2016 Annual Report and Financial Statements | | FOR | | p. 29 |

Proposal 8 | | Approve the Retention of Disposable Profits | | FOR | | p. 29 |

Proposal 9 | | Elect Deloitte & Touche LLP as Independent Auditor and Deloitte AG as Statutory Auditor | | FOR | | p. 30 |

Proposal 10 | | Elect PricewaterhouseCoopers AG as Special Auditor | | FOR | | p. 30 |

Proposal 11 | | Discharge of the Board of Directors and Executive Officers from Liabilities | | FOR | | p. 31 |

-3-

| Corporate Governance Highlights |

The company is committed to strong corporate governance, which promotes the long-term interests of shareholders, should be aware that a vote in favorstrengthens the accountability of the Amendment Proposal orboard of directors (the “Board”) and management and helps build public trust in the Special Dividend Proposalcompany. Highlights include the following:

| | | | | | | | | |

| | Board and Other Governance Information | | | 2017 | | |||

| | | | | |||||

| | | | | | | | | |

|

| | | | 8 | | | |

|

| | | 62.6 | | |||

| |

| | | | 87.5% | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | No | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | 15 | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| |

| | | | Yes | | |

|

| | | Yes | | |||

| | | | | | | | | |

-4-

| Our Director Nominees |

You are being asked to vote on the election of the following eight directors to the Board. All directors are elected annually by a majority of the votes cast. Detailed information about each director’s background and key attributes, experience and skills can be found beginning on page 15 of this Proxy Statement.

| | | | | Director Since | | Primary Occupation | | Principal Skills | | | | Committees | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name | | Age | | Independent | | AC | | CC | | ERC | | Exec | | IC | | N&CG | ||||||

| Barbara T. Alexander | | 68 | | 2009 | | Independent Consultant | | Corporate Finance, Investment, Strategic Planning | | Yes | | C | | · | | · | | | | · | | |

| Scott Carmilani | | 52 | | 2003 | | President, CEO and Chairman Allied World Assurance Company Holdings, AG | | Insurance and Reinsurance Industry Leadership | | No | | | | | C | | | |||||

| Bart Friedman | | 72 | | 2006 | | Senior Counsel Cahill Gordon Reindel LLP | | Investment, Corporate Governance | | Lead Independent Director | | | | · | | | | | | · | | C |

| Patricia L. Guinn | | 62 | | 2015 | | Former Managing Director Towers Watson | | Insurance and Reinsurance, Risk Management | | Yes | | · | | | · | | | | · | |||

| Fiona E. Luck | | 59 | | 2015 | | Former Senior Executive XL Group plc | | Insurance and Reinsurance, Corporate Finance | | Yes | | | | · | | · | | · | | | | |

| Patrick de Saint-Aignan | | 68 | | 2008 | | Former Advisory Director Morgan Stanley | | Corporate Finance, Risk Management, Investment | | Yes | | · | | · | | C | | | · | | ||

| Eric S. Schwartz | | 54 | | 2013 | | CEO and Founder 76 West Holdings | | Corporate Finance, Investment | | Yes | | | | · | | | | | | C | | |

| Samuel J. Weinhoff | | 66 | | 2006 | | Independent Consultant | | Corporate Finance, Insurance and Reinsurance, Strategic Planning | | Yes | | · | | C | | · | | · | | · | | · |

| C | | Chair | | | ||

| AC | | Audit Committee | | Exec | | Executive Committee |

| CC | | Compensation Committee | | IC | | Investment Committee |

| ERC | | Enterprise Risk Committee | | N&CG | | Nominating & Corporate Governance Committee |

-5-

| Executive Compensation Philosophy and Goals |

The Compensation Committee believes that an effective executive compensation program is one that:

The Compensation Committee’s objectives for the company’s compensation programs are to:

| Shareholder Engagement |

The Compensation Committee values the opinions expressed by shareholders on the design and effectiveness of the company’s executive compensation programs. Prior to 2016, shareholders strongly supported the company’s executive compensation programs, approving the advisory votes on executive compensation with 98.4%, 98.8% and 98.9% support in 2013, 2014 and 2015, respectively.

At the company’s Annual Shareholder Meeting isheld in April 2016, shareholders approved the company’s binding executive compensation proposal with 99.4% support. However, shareholders approved the company’s advisory say-on-pay proposal with a lower level of support of 64.3%, even though the company’s compensation program design had not a vote in favor of, or a tender of our common shares into, the offer. The offer has not commenced. At the time the offer is commenced, Fairfax will filematerially changed from prior years and overall compensation levels had substantially decreased commensurate with the U.S. Securities and Exchange Commission (the “SEC”): (i) a registration statement on Form F-4, which will include a prospectus of Fairfax in respectcompany’s financial performance. As part of the Fairfax sharesproxy solicitation process, and following the 2016 Annual Shareholder Meeting, the company engaged in an extensive shareholder outreach effort, contacting its 28 largest institutional shareholders representing approximately 63% of its outstanding shares. Members of the company’s management, its Investor Relations Department and, in some cases, the independent Chair of the Compensation Committee, conducted conference calls with those shareholders that responded to be issued inoutreach efforts to solicit shareholder feedback, respond to questions and ensure that shareholders understand the offer;company’s executive compensation programs and (ii) a tender offer statementare afforded an opportunity to voice any concerns.

-6-

Shareholders noted that they generally supported the company’s compensation program design, particularly the emphasis on Schedule TO (together with related documents, including an offer to exchangelong-term, performance-based equity awards that reflected the company’s strong pay-for-performance philosophy. Shareholders also noted that they appreciated the company’s outreach efforts and a related form of letter of transmittal), and Allied World will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the offer. These documents will contain important information about the offer that should be read carefully before any decision is made with respect to the offer. By voting on the proposals in this proxy statement, you are not making a decision with respect to the offer. You will have the opportunity to elect whether to tender your sharesengage in discussions with the offer at a later date onceindependent Chair of the offer is commenced.Compensation Committee. Although shareholders did not identify any specific issues with the company’s executive compensation programs, the Compensation Committee deliberated on the results of the 2016 say-on-pay vote in multiple meetings and considered shareholder feedback, market data and advice from its independent compensation consultant in its ongoing review of the compensation program design.

-2--7-

![]()

PROXY STATEMENT

-8-

-3-

| | | Proposal | | Vote Required | | Effect of Abstentions | | Effect of “Broker Non-Votes” |

|---|---|---|---|---|---|---|---|---|

| | | | |||||

| 1 | | | | Vote | | Vote not counted | ||

2 | | | Majority of votes | | Vote not counted | | Vote not counted | |

3 | | Elect the Compensation Committee Members | | Majority of votes cast | | Vote not counted | | Vote not counted |

-4--9-

| | Proposal | | Vote Required | | Effect of Abstentions | | Effect of “Broker Non-Votes” | |

|---|---|---|---|---|---|---|---|---|

| | | | |||||

| 4 | | Elect the Independent Proxy | | Majority of votes cast | | Vote not counted | | Vote not counted |

5 | | Advisory Vote on 2016 Executive Compensation as Required Under U.S. Securities Laws | | Majority of votes cast | | Vote not counted | | Vote not counted |

6 | | Advisory Vote on Frequency of the Shareholder Vote on Executive Compensation as Required Under U.S. Securities Laws | | Majority of votes cast | | Vote not counted | | Vote not counted |

7 | | Approve the 2016 Annual Report and Financial Statements | | Majority of votes cast | | Vote not counted | | Brokers have discretion to vote |

8 | | Approve the Retention of Disposable Profits | | Majority of votes cast | | Vote not counted | | Brokers have discretion to vote |

9 | | Elect Deloitte & Touche LLP as Independent Auditor and Deloitte AG as Statutory Auditor | | Majority of votes cast | | Vote not counted | | Brokers have discretion to vote |

10 | | Elect PricewaterhouseCoopers AG as Special Auditor | | Majority of votes cast | | Vote not counted | | Brokers have discretion to vote |

11 | | Discharge of the Board of Directors and Executive Officers from Liabilities | | Majority of votes cast | | Vote not counted | | Vote not counted |

-10-

Q:

-5-

-11-

-6-

-12-

-7--13-

| Organizational Matters Required by Swiss Law |

Admission to the SpecialAnnual Shareholder Meeting

Shareholders who are registered in our share register on the Record Date will receive the Proxy Statement and proxy card from Continental Stock Transfer & Trust Company, our transfer agent. Beneficial owners of shares will receive instructions from their bank, brokerage firm or other nominee acting as shareholder of record to indicate how they wish their shares to be voted. Beneficial owners who wish to vote in person at the SpecialAnnual Shareholder Meeting must obtain a power of attorney from their bank, brokerage firm or other nominee that authorizes them to vote the shares held by them on their behalf. In addition, you must bring to the SpecialAnnual Shareholder Meeting an account statement or letter from your bank, brokerage firm or other nominee indicating that you are the owner of the common shares. Shareholders of record registered in our share register are entitled to participate in and vote at the SpecialAnnual Shareholder Meeting. Each share is entitled to one vote. The exercise of voting rights is subject to the voting restrictions set out in the company’s Articles of Association, a summary of which is contained in “— How many votes do I have?” Please see the questions and answers provided under “— SpecialGeneral Meeting Information” for further information.

Granting a Proxy

If you are a shareholder of record, please see “— How do I vote?” and “— How do I appoint and vote via an independent proxy if I am a shareholder of record?” above in the Proxy Statement for more information on appointing an independent proxy.

Registered shareholders who have appointed the independent proxy as a proxy may not vote in person at the SpecialAnnual Shareholder Meeting or send a proxy of their choice to the meeting unless they revoke or change their proxies. Revocations to the independent proxy must be received by him by no later than 6:00 a.m., local time, on March 22,June 21, 2017 either by mail to Buis Buergi AG, Muehlebachstrasse 8, P.O. Box 672, CH-8024 Zurich, Switzerland or by e-mail at proxy@bblegal.ch.

As indicated on the proxy card, with regard to the items listed on the agenda and without any explicit instructions to the contrary, the independent proxy will vote according to the recommendations of the Board. If new agenda items (other than those on the agenda) or new proposals or motions regarding agenda items set out in the invitation to the SpecialAnnual Shareholder Meeting are being put forth before the meeting, the independent proxy will vote in accordance with the position of the Board in the absence of other specific instructions.

Beneficial owners who have not obtained a power of attorney from their bank, brokerage firm or other nominee are not entitled to participate in or vote at the SpecialAnnual Shareholder Meeting.

Admission Office

The admission office opens on the day of the SpecialAnnual Shareholder Meeting at 1:30 p.m. local time. Shareholders of record attending the meeting are kindly asked to present their proxy card as proof of admission at the entrance.

-8-Annual Report of Allied World Assurance Company Holdings, AG

The company’s 2016 Annual Report, which accompanies this Proxy Statement, contains the company’s audited consolidated financial statements, its audited statutory financial statements prepared in accordance with Swiss law and the remuneration report of the board of directors and executives required under Swiss law. The 2016 Annual Report can be accessed through the company’s website at www.awac.com under the “Financial Reports” link located in the section entitled “Investors.” Copies of the 2016 Annual Report may be obtained without charge upon written request to the Corporate Secretary, attention: Theodore Neos, at Allied World Assurance Company Holdings, AG, Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland, or via e-mail at secretary@awac.com. The 2016 Annual Report may be physically inspected at the company’s headquarters at Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland.

-14-

PROPOSAL 1

ELECT THE BOARD OF DIRECTORS

Each member of our Board is being nominated for election at this Annual Shareholder Meeting. Each of the nominees is a current member of the Board and was recommended for appointment to the Board by the Nominating & Corporate Governance Committee to serve until the Annual Shareholder Meeting in 2018.

Your Board unanimously recommends a vote FOR each of the nominees as listed on the enclosed proxy card. It is not expected that any of the nominees will become unavailable for election as a director but, if any nominee should become unavailable prior to the meeting, proxies will be voted in accordance with the general instructions provided on the proxy card with regard to such other person as your Board shall recommend and nominate. In the absence of other specific instructions, proxies will be voted as your Board shall recommend.

The biography of each nominee below contains information regarding the person’s service as a director on the Board, his or her business experience, director positions at other companies held currently or at any time during the last five years, and his or her applicable experiences, qualifications, attributes and skills.

Nominees for Election

| | | | | |

| | Barbara T. Alexander, 68 | | ||

| | | | | |

| | Position, Principal Occupation and Business Experience: Ms. Alexander has been an independent consultant since January 2004. Prior to that, she was a Senior Advisor to UBS AG and predecessor firms from October 1999 to January 2004, and Managing Director of the North American Construction and Furnishings Group in the Corporate Finance Department of UBS from 1992 to October 1999. From 1987 to 1992, Ms. Alexander was a Managing Director in the Corporate Finance Department of Salomon Brothers Inc. From 1972 to 1987, she held various positions at Salomon Brothers, Smith Barney, Investors Diversified Services, and Wachovia Bank and Trust Company. Ms. Alexander is currently a member of the board of directors of QUALCOMM Incorporated, where she is Chairperson of the Compensation Committee; and Choice Hotels International, Inc., where she is Chairperson of the Audit Committee and a member of the Diversity Committee. Ms. Alexander previously served on the board of directors of KB Home from October 2010 to April 2014, Federal Home Loan Mortgage Corporation (Freddie Mac) from November 2004 to March 2010, Centex Corporation from July 1999 to August 2009, Burlington Resources Inc. from January 2004 to March 2006 and Harrah’s Entertainment Inc. from February 2002 to April 2007. Ms. Alexander was selected as one of seven Outstanding Directors in Corporate America in 2003 by Board Alert magazine and was one of five Director of the Year honorees in 2008 by the Forum for Corporate Directors. She has also served on the board of directors of HomeAid America, Habitat for Humanity International and Covenant House. Key Attributes, Experience and Skills: Having been a member of numerous public company boards of directors, Ms. Alexander is familiar with a full range of corporate and board functions. She also has extensive experience in corporate finance, investment and strategic planning matters. The Board believes that, among other qualifications, Ms. Alexander’s extensive experience in corporate finance, investment and strategic planning matters gives her the skills to serve as a director. | | Director Since: August 2009 Board Committees: Audit (Chair), Compensation, Enterprise Risk and Investment Other Current Public Boards: QUALCOMM Incorporated (NASDAQ: QCOM) and Choice Hotels International (NYSE: CHH) |

-15-

| | | | | |

| | | |||

| | | | | |

| | Position, Principal Occupation and Business Experience: Mr. Carmilani was elected our President and Chief Executive Officer in January 2004 and was appointed Chairman of the Board in January 2008. Mr. Carmilani was, prior to joining our company as Executive Vice President in February 2002, the President of the Mergers & Acquisition Insurance Division of subsidiaries of American International Group, Inc. (“AIG”) and responsible for the management, marketing and underwriting of transactional insurance products for clients engaged in mergers, acquisitions or divestitures. Mr. Carmilani was previously the Regional Vice-President overseeing the New York general insurance operations of AIG. Before that he was the Divisional President of the Middle Market Division of National Union Fire Insurance Company of Pittsburgh, Pa., which underwrites directors and officers liability, employment practice liability and fidelity insurance for middle-market-sized companies. Prior to joining our company, he held a succession of underwriting and management positions with Key Attributes, Experience and Skills: The Board believes that, among other qualifications, Mr. Carmilani’s extensive expertise and experience in the insurance and reinsurance industry give him the skills to serve as a director. | | Director Since: September 2003 Board Committees: Executive (Chair) Other Current Public Boards: None | |

| | | |||

| | | | | |

| | Bart Friedman, 72 | | ||

| | | | | |

| | Position, Principal Occupation and Business Experience: Mr. Friedman was elected Vice Chairman of the Board in July 2006 and was appointed Lead Independent Director of the Board in January 2008. Mr. Friedman was a partner at Cahill Gordon & Reindel LLP, a New York law firm (“Cahill”), from 1980 to 2016 and has served as Senior Counsel at Cahill since January 2017. Mr. Friedman specializes in corporate governance, special committees and director representation. Mr. Friedman worked early in his career at the SEC. Mr. Friedman is currently chairman of the board of directors of Sanford Bernstein Mutual Funds, where he is a member of the Audit Committee and the Nominating and Governance Committee, and a member of the board of directors of Ovid Therapeutics Inc., where he is chairman of the Audit Committee. He is also the chairman of the Audit Committee of The Brookings Institution, a member of the board of directors of the Lincoln Center for the Performing Arts, where he is chairman of the Audit Committee and the Compensation Committee, and a member of the board of trustees of the Cooper-Hewitt Smithsonian Design Museum, where he serves as Treasurer. Key Attributes, Experience and Skills: The Board believes that, among other qualifications, Mr. Friedman’s extensive expertise and experience in corporate governance and investment matters give him the skills to serve as a director. | | Director Since: March 2006 Lead Independent Director Board Committees: Compensation, Investment and Nominating & Corporate Governance (Chair) Other Current Public Boards: Sanford Bernstein Mutual Funds |

Bid Sub will offer to acquire all-16-

| | | | | |

| | Patricia L. Guinn, 62 | | ||

| | | | | |

| | Position, Principal Occupation and Business Experience: Ms. Guinn retired from Towers Watson in June 2015 where she served as Managing Director of its Risk and Financial Services segment and a member of its Management Committee since 2010. Prior to this, she held a variety of leadership roles at Towers Perrin, one of Towers Watson’s predecessor companies, which she joined in 1976. For more than 30 years, Ms. Guinn has consulted on risk management, mergers and acquisitions, financial analysis and performance measurement for insurance companies. She is currently a member of the board of directors of Reinsurance Group of America, Incorporated. Ms. Guinn previously served on the board of directors of Towers Perrin from 2001 to 2005 and again from 2008 to 2010. Ms. Guinn is currently a director of the International Insurance Society. She is a Fellow of the Society of Actuaries, a member of the American Academy of Actuaries and a Chartered Enterprise Risk Analyst. Key Attributes, Experience and Skills: The Board believes that, among other qualifications, Ms. Guinn’s extensive experience in the insurance and reinsurance industry as well as expertise with risk management matters give her the skills to serve as a director. | | Director Since: December 2015 Board Committees: Audit, Enterprise Risk and Nominating & Corporate Governance Other Current Public Boards: Reinsurance Group of America, Incorporated (NYSE: RGA) | |

| | | |||

| | | | | |

| | Fiona E. Luck, 59 | | ||

| | | | | |

| | Position, Principal Occupation and Business Experience: Ms. Luck served as Executive Vice President and Chief of Staff at XL Group plc (“XL”) from June 2006 until June 2009 and then Special Advisor to the Chief Executive Officer until January 2010. From 1999 to 2006, she served in various roles at XL, including as Executive Vice President of Group Operations and Interim Chief Financial Officer. From 1997 to 1999, she served as Senior Vice President of Financial Lines and later as Executive Vice President of Joint Ventures and Strategic Alliances at ACE Bermuda Insurance Ltd. From 1983 to 1997, she served in various roles at Marsh and McLennan, Inc., including as Managing Director and Head of the Global Broking operations in Bermuda. She is currently a member of the board of directors of the Bermuda Monetary Authority where she serves on its Audit & Risk Management Committee, Human Capital Committee and Non-Executive Directors Committee; and Gen Life Ltd and Gen Two Ltd. She previously served on the board of directors of Catlin Group Ltd from August 2012 until its merger with XL in May 2015 where she was Chair of the Compensation Committee and a member of the Audit, Investment and Nomination Committees. She also served on the board of directors of Kenbelle Capital LP from 2012 to 2015, Hardy Underwriting Bermuda Ltd. from 2010 to 2012 and Primus Guaranty Ltd. from 2007 to 2009. Ms. Luck also serves on the board of trustees of the David Shepherd Wildlife Foundation and the board of directors of Knowledge Quest. She is a member of the Institute of Chartered Accountants of Scotland. Key Attributes, Experience and Skills: The Board believes that, among other qualifications, Ms. Luck’s extensive expertise and experience in the insurance and reinsurance industry give her the skills to serve as a director. | | Director Since: December 2015 Board Committees: Compensation, Enterprise Risk and Executive Other Current Public Boards: None |

-17-

| | | | | |

| | Patrick de Saint-Aignan, 68 | | ||

| | | | | |

| | Position, Principal Occupation and Business Experience: Mr. de Saint-Aignan held multiple positions at Morgan Stanley internationally from 1974 to 2007, where he was a Managing Director and, most recently, an Advisory Director. He held responsibilities in corporate finance and capital markets and headed successively Morgan Stanley’s global fixed income derivatives and debt capital markets activities, its office in Paris, France, and the firm-wide risk management function. He was also a Founder, Director and Chairman of the International Swaps and Derivatives Association (1985-1992); Censeur on the Supervisory Board of IXIS Corporate and Investment Bank (2005-2007); a member of the board of directors of Bank of China Limited (2006-2008), where he was Chairman of the Audit Committee and a member of the Risk Policy Committee and the Personnel and Remuneration Committee; and a member of the board of directors and non-executive Chairman of the European Kyoto Fund (2010-2011). Mr. de Saint-Aignan is currently a member of the board of directors of State Street Corporation, where he is a member of its Risk Committee and its Examining and Audit Committee. Key Attributes, Experience and Skills: The Board believes that, among other qualifications, Mr. de Saint-Aignan’s broad experience and expertise in corporate finance, risk management and investment matters as well as his international business background give him the skills to serve as a director. | | Director Since: August 2008 Board Committees: Audit, Compensation, Enterprise Risk (Chair) and Investment Other Current Public Boards: State Street Corporation (NYSE: STT) |

-18-

| | | | | |

| | Eric S. Schwartz, 54 | | ||

| | | | | |

| | Position, Principal Occupation and Business Experience: Mr. Schwartz is the founder and has been Chief Executive Officer of 76 West Holdings, a private investment company, since June 2008. In support of the activities of 76 West, he has served as Chairman of Applied Data Finance, LLC, a non-prime consumer finance company, since November 2014; as a director of Demica Limited, a trade finance company, since July 2014; as former Chairman and more recently a director of Jefferson National Financial Corp., an insurance company focused on the variable annuity market, since January 2012; as Chairman of Gold Bullion International LLC, a precious metals dealer, since January 2012; as a director of Indostar Capital Finance, a finance company based in India, since April 2011; and as a director of Binary Event Network, an electronic prediction marketplace, since May 2011. He served as a director of Atlanta Hawks Basketball & Entertainment, LLC from March 2014 to June 2015. He also served as Chairman-elect of Nikko Asset Management from June 2008 until its sale in June 2009; and as a director of Prosper Marketplace, an internet-based consumer lending company, from March 2012 until January 2013. Mr. Schwartz is a former Co-CEO of Goldman Sachs Asset Management. He joined The Goldman Sachs Group, Inc. (“Goldman Sachs”) in 1984 and served in various leadership positions at the firm during his tenure at Goldman Sachs. In 1994, he became a partner in the Equity Capital Markets unit of Goldman Sachs’ Investment Banking Division and later served as Co-Head of its Global Equities and Investment Management Divisions. He joined Goldman Sachs’ Management Committee in 2001 and was named Co-Head of its Partnership Committee in 2005. In June 2007, he retired from Goldman Sachs. He serves as a member of the Investment Committee for the endowment of UJA-Federation New York, where he served as its Chairman for many years, and as a director of the Food Bank for New York City, Securing America’s Future Energy, City Harvest and The Jewish Community Center Krakow, Poland. Key Attributes, Experience and Skills: The Board believes that, among other qualifications, Mr. Schwartz’s broad experience and expertise in corporate finance and investment matters as well as his international business background give him the skills to serve as a director. | | Director Since: October 2013 Board Committees: Compensation and Investment (Chair) Other Current Public Boards: None |

-19-

| | | | | |

| | Samuel J. Weinhoff, 66 | | ||

| | | | | |

| | Position, Principal Occupation and Business Experience: Mr. Weinhoff has served as a consultant to the insurance industry since 2000. Prior to this, Mr. Weinhoff was head of the Financial Institutions Group for Schroder & Co. from 1997 until 2000. He was also a Managing Director at Lehman Brothers, where he worked from 1985 to 1997. Mr. Weinhoff had ten years prior experience at the Home Insurance Company and the Reliance Insurance Company in a variety of positions, including excess casualty reinsurance treaty underwriter, investment department analyst, and head of corporate planning and reporting. Mr. Weinhoff is currently the Lead Director on the board of directors of Infinity Property and Casualty Corporation where he is a member of the Executive Committee and Chairman of the Nominating and Governance Committee. Mr. Weinhoff served on the board of directors of Inter-Atlantic Financial, Inc. from July 2007 to October 2009. Key Attributes, Experience and Skills: The Board believes that, among other qualifications, Mr. Weinhoff’s extensive insurance and reinsurance industry experience as well as expertise in corporate finance and strategic planning matters give him the skills to serve as a director. | | Director Since: July 2006 Board Committees: Audit, Compensation (Chair), Enterprise Risk, Executive, Investment and Nominating & Corporate Governance Other Current Public Boards: Infinity Property and Casualty Corporation (NASDAQ: IPCC) |

| Board and Committee Membership(1) |

Name | | Audit | | Compensation | | Enterprise Risk | | Executive | | Investment | | Nominating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Barbara T. Alexander* | | C | | · | | · | | | | · | | |

Scott A. Carmilani | | | | | C | | | |||||

Bart Friedman** | | | | · | | | | | | · | | C |

Patricia L. Guinn* | | · | | | · | | | | · | |||

Fiona E. Luck* | | | | · | | · | | · | | | | |

Patrick de Saint-Aignan* | | · | | · | | C | | | · | | ||

Eric S. Schwartz* | | | | · | | | | | | C | | |

Samuel J. Weinhoff* | | · | | C | | · | | · | | · | | · |

| | | | | | | | | | | | | |

Number of 2016 Meetings | | 5 | | 4 | | 4 | | 0 | | 4 | | 3 |

· Member | | C Chair | | * Independent Director | | ** Lead Independent Director |

Director Independence

The Board has determined that Mses. Alexander, Guinn and Luck, and Messrs. Friedman, de Saint-Aignan, Schwartz and Weinhoff are independent directors under the listing standards of the outstanding common sharesNew York Stock Exchange (the “NYSE”). We require that a majority of Allied World uponour directors meet the termscriteria for independence under applicable law and subjectthe rules of the NYSE. The Board has adopted a policy to assist it and the Nominating & Corporate Governance Committee in their determination as to whether a nominee or director qualifies as independent. This policy contains categorical standards for determining independence and includes the independence standards required by the SEC and the NYSE, as well as standards published by institutional investor groups and other corporate governance experts. In making its determination of independence, the Board applied these standards for director independence and determined that no material relationship existed between the company and these directors. A copy of the Board Policy on Director Independence was attached as an appendix to the conditions set outcompany’s Proxy Statement filed with the SEC on March 13, 2015.

-20-

Meetings and Committees of the Board

During the year ended December 31, 2016, there were fifteen meetings of our Board, five meetings of the Audit Committee, four meetings of the Compensation Committee, four meetings of the Enterprise Risk Committee, no meeting of the Executive Committee, four meetings of the Investment Committee and three meetings of the Nominating & Corporate Governance Committee. Each of our directors other than Mr. Friedman attended at least 75% of the aggregate number of Board meetings and committee meetings of which he or she was a member during the period he or she served on the Board. Mr. Friedman missed three Board meetings and contemporaneous committee meetings due to medical issues, bringing his overall attendance rate to less than 75% of the aggregate number of Board meetings and committee meetings of which he was a member in 2016. Our non-management directors meet separately from the other directors in an executive session at least quarterly. Mr. Friedman, our Vice Chairman of the Board and Lead Independent Director, or his designee, served as the presiding director of the executive sessions of our non-management and independent directors held in 2016. The Lead Independent Director also has the authority to call meetings of the independent directors or full Board.

Board Leadership Structure

The Board has chosen a leadership structure that combines the role of the Chief Executive Officer and the Chairman of the Board while also having a Lead Independent Director. The Lead Independent Director assumes many of the responsibilities typically held by a non-executive chairman of the board and a list of his responsibilities is provided in the chart below. The company’s rationale for combining the AgreementChief Executive Officer and PlanChairman of Merger, dated as of December 18, 2016, between Fairfax and Allied World, as may be amended from time to time (the “Merger Agreement”).

Pursuantthe Board positions relates principally to the Merger Agreement, Allied WorldBoard’s belief that at this stage of our development, the company and its shareholders will be offeredbest served if the Chairman is in close proximity to the senior management team on a combinationregular and continual basis.

| | | | | | |

| | | | |||

| | Lead Independent Director | | |||

| | | | |||

| | The Lead Independent Director is elected solely by and from the independent directors. Responsibilities include: | | |||

| | | | |||

| | | · organizing and presiding over all meetings of the Board at which the Chairman of the Board is not present, including all executive sessions of the non-management and independent directors; | | ||

| | | | |||

| | | · serving as the liaison between the Chairman of the Board and the non-management directors; | | ||

| | | | |||

| | | · overseeing the information sent to the Board by management; | | ||

| | | | |||

| | | · approving meeting agendas and schedules for the Board to assure that there is sufficient time for discussion of all agenda items; | | ||

| | | | |||

| | | · facilitating communication between the Board and management; | | ||

| | | | |||

| | | · being available to communicate with and respond to certain inquiries of the company’s shareholders; and | | ||

| | | | |||

| | | · performing such other duties as requested by the Board. | | ||

| | | | | | |

Our Board has also approved Corporate Governance Guidelines, a Code of cashBusiness Conduct and stockEthics and a Code of Ethics for Chief Executive Officer and Senior Financial Officers. Printed copies of these documents as well as the committee charters discussed below are available by sending a written

-21-

request to our Corporate Secretary. The foregoing information is available on our website at www.awac.com under “Investors — Corporate Information — Governance Documents”.

Audit Committee. Pursuant to its charter, the Audit Committee is responsible for overseeing our independent auditors, internal auditors, compliance with legal and regulatory standards and the integrity of our financial reporting. Each member of the Audit Committee has been determined by the Board to be “financially literate” within the meaning of the NYSE Listing Standards and each has been designated by the Board as an “audit committee financial expert,” as defined by the applicable rules of the SEC, based on either their extensive prior accounting and auditing experience or having a range of experience in varying executive positions in the insurance or financial services industry.

Compensation Committee. Pursuant to its charter, the Compensation Committee has the authority to establish compensation policies and recommend compensation programs to the Board, including administering all equity and incentive compensation plans of the company. Pursuant to its charter, the Compensation Committee also has the authority to review the competitiveness of the non-management directors’ compensation programs and recommend to the Board these compensation programs and all payouts made thereunder. Additional information on the Compensation Committee’s consideration of executive compensation, including a discussion of the roles of the company’s Chief Executive Officer and the independent compensation consultant in such executive compensation consideration, is included in “Executive Compensation — Compensation Discussion and Analysis.”

Enterprise Risk Committee. Pursuant to its charter, the Enterprise Risk Committee oversees management’s assessment and mitigation of the company’s enterprise risks and reviews and recommends to the Board for each common share, including:approval the company’s overall firm-wide risk appetite statement and oversees management’s compliance therewith.

Executive Committee. The Executive Committee has the authority to oversee the general business and affairs of the company to the extent permitted by Swiss law.

Investment Committee. Pursuant to its charter, the Investment Committee is responsible for adopting and overseeing compliance with the company’s Investment Policy Statement, which contains investment guidelines and other parameters for the investment portfolio. The Investment Committee oversees the company’s overall investment strategy and the company’s investment risk exposures.

Nominating & Corporate Governance Committee. Pursuant to its charter, the Nominating & Corporate Governance Committee is responsible for identifying individuals believed to be qualified to become directors and to recommend such individuals to the Board and to oversee corporate governance matters and practices.

The criteria adopted by the Board for use in evaluating the suitability of all nominees for director include the following:

| | · | | |

| | · | | |

| | · | | |

| | · | | ability and willingness to commit adequate time to the |

If,-22-

In addition to considering candidates suggested by shareholders, the Nominating & Corporate Governance Committee considers candidates recommended by current directors, officers and others. The Nominating & Corporate Governance Committee screens all director candidates. The Nominating & Corporate Governance Committee determines whether or not the candidate meets the company’s general qualifications and specific qualities for directors and whether or not additional information is appropriate.

The Board and the Nominating & Corporate Governance Committee do not have a specific policy regarding diversity. Instead, in addition to the general qualities that the Board requires of all nominees and directors, such as high personal and professional ethics, values and integrity, the Board and the Nominating & Corporate Governance Committee strive to have a diverse group of directors with differing experiences, qualifications, attributes and skills to further enhance the quality of the Board. As we are an insurance and reinsurance company that (i) sells products that protect other companies and individuals from complex risks, (ii) has a significant investment portfolio and (iii) faces operational risks similar to those at other international companies, the Board and the Nominating & Corporate Governance Committee believe that having a group of directors who have the range of experience and skills to understand and oversee this type of business is critical. The Board and the Nominating & Corporate Governance Committee do not believe that each director must be an expert in every aspect of our business, but instead strive to have well-rounded, collegial directors who contribute to the diversity of ideas and strengthen the Board’s capabilities as a whole. Through their professional careers and experiences, the Board and the Nominating & Corporate Governance Committee believe that each director has obtained certain attributes that further the goals discussed above.

Risk Oversight

While the assumption of risk is inherent to our business, we believe we have developed a strong risk management culture throughout our organization that is fostered and maintained by our senior management, with oversight by the Board through its committees. The Board primarily delegates its risk management oversight to three of its committees: the Audit Committee, the Enterprise Risk Committee and the Investment Committee, who regularly report to the Board. The Audit Committee primarily oversees those risks that may directly or indirectly impact the company’s financial statements, the Enterprise Risk Committee primarily oversees the company’s business and operational risks and the Investment Committee primarily oversees the company’s investment portfolio risks. The Enterprise Risk Committee also reviews and recommends for approval by the Board our overall firm-wide risk appetite statement, and oversees management’s compliance with this statement. Each committee has broad powers to ensure that it has the resources to satisfy its duties under its charter, including the ability to request reports from any officer or employee of the company and the authority to retain special counsel or other experts and consultants as it deems appropriate.

Each of these committees receives regular reports from senior management who have day-to-day risk management responsibilities, including from our Chief Executive Officer. The Audit Committee receives reports from our Chief Executive Officer, Chief Financial Officer, Chief Actuary, General Counsel, Chief Information Officer, Head of Internal Audit and the company’s independent auditors. These reports address various aspects of risk assessment and management relating to the company’s financial statements. The Enterprise Risk Committee meets regularly with our Chief Executive Officer; President, Underwriting and Global Risk; Chief Risk Officer; and Chief Actuary as part of its oversight of the company’s underwriting, pricing and claims risks. Throughout the year, the Enterprise Risk Committee will also receive reports from other operational areas. To assist it in its oversight of the company’s investment risk exposures, the Investment Committee receives reports from our senior investment personnel.

-23-

As open communications and equal access to information can be an important part of the Board’s risk oversight, all of the directors receive the information sent to each committee prior to any committee meeting. Board members are also encouraged to, and often do, attend all committee meetings regardless of whether he or she is a member of such committee.

Director Compensation

In 2016, compensation for our non-management directors consisted of the following:

| Fees for Non-Management Directors |

| | Position | | Annual Cash Retainers | | Annual Value of RSU Award | | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Board Member | | | $ | 85,000 | | | | $ | 90,000 | | |

| | Lead Independent Director | | | $ | 15,000 | | | | — | | | |

| | Audit Committee and Enterprise Risk Committee Chair | | | $ | 50,000 | | | | — | | | |

| | Compensation Committee and Investment Committee Chair | | | $ | 35,000 | | | | — | | | |

| | Nominating & Corporate Governance Committee Chair | | | $ | 8,000 | | | | — | | | |

| | Audit Committee Member | | | $ | 25,000 | | | | — | | | |

Our non-management directors received $3,000 for each Board meeting attended and $2,000 for each committee meeting attended. We also provide to all non-management directors reimbursement of expenses incurred in connection with their service on the Board, including the reimbursement of director educational expenses.

As discussed in footnote 2 to the “Stock Awards” column of the “Non-Management Directors Compensation” table below, in February 2016, each non-management director received an annual equity award of restricted stock units (“RSUs”) of the company worth approximately $90,000. Each RSU represents the right to receive one newly-issued, fully paid and non-assessable common share of the company at a future date and fully vests on the first anniversary of the date of grant, subject to continued service as a director through such date. The RSUs were awarded to our non-management directors pursuant to the Allied World Assurance Company Holdings, AG 2012 Omnibus Incentive Compensation Plan (the “2012 Omnibus Plan”) and, other than with respect to vesting terms, were granted on similar terms and conditions as those generally granted to our employees. In 2016, these annual equity awards were granted concurrently with the grant of equity awards to members of our senior management following the preparation and completion of the offer, Fairfax has acquired2016 year-end financial statements.

-24-

The following table provides information concerning the compensation paid to the company’s non-management directors for fiscal year 2016.

| Non-Management Directors Compensation(1) |

Name | | Fees Earned or Paid in Cash | | Stock Awards(2) | | Other Compensation(3) | | Total | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Barbara T. Alexander | | | $ | 214,000 | | | | $ | 87,447 | | | | $ | 5,000 | | | $ | 306,447 | |

James F. Duffy(4) | | | $ | 57,666 | | | | $ | — | | | | $ | 7,509 | | | $ | 65,175 | |

Bart Friedman | | | $ | 156,000 | | | | $ | 87,447 | | | | $ | — | | | $ | 243,447 | |

Patricia L. Guinn | | | $ | 167,875 | | | | $ | 87,447 | | | | $ | 10,000 | | | $ | 265,322 | |

Fiona E. Luck | | | $ | 142,000 | | | | $ | 87,447 | | | | $ | 10,000 | | | $ | 239,447 | |

Patrick de Saint-Aignan | | | $ | 239,000 | | | | $ | 87,447 | | | | $ | 10,000 | | | $ | 336,447 | |

Eric S. Schwartz | | | $ | 174,000 | | | | $ | 87,447 | | | | $ | — | | | $ | 261,447 | |

Samuel J. Weinhoff | | | $ | 227,000 | | | | $ | 87,447 | | | | $ | 10,000 | | | $ | 324,447 | |

-9-

The obligation of Fairfax to consummate the offer is subject to other conditions, including (i) approval by Allied World shareholders of the Amendment Proposal and the Special Dividend Proposal; (ii) approval by Allied World’s shareholders to elect the individuals designated by Fairfax to Allied World’s board of directors upon or after completion of the offer, such approval to be addressed in a separate proxy statement in connection with a vote at a separate special shareholder meeting, as may be waived by Fairfax; (iii) to the extent required by applicable laws and regulations (based on the total numberdate of Fairfax Shares to be issued as considerationgrant ($31.95 per common share for the transactions), approval by Fairfax’s shareholdersawards issued on February 22, 2016). In determining the fair value of awards for directors and all of our employees, the issuance of Fairfax Shares as consideration forBoard uses the transactions; (iv) a numberdaily volume-weighted average sales price of our common shares having been validly tenderedfor the 20 consecutive trading days up to and including the second trading day prior to the date of grant ($32.88 per common share, or a $89,993 aggregate grant to each director on February 22, 2016).

Stock Ownership Policy

In order to promote equity ownership and further align the interests of the Board with our shareholders, the Board adopted a stock ownership policy for all non-management directors. Under this policy, a non-management director is expected to own, within five years after his or her joining the Board, equity interests of the company with a value equal to five times the then-current annual cash retainer for serving on the Board. Non-management directors are expected not properly withdrawn that represents 90% of ourto sell any common shares outstanding (provided that,until they are in the event allcompliance with this policy. Mr. Carmilani, our President, Chief Executive Officer and Chairman of the other conditionsBoard, is subject to the offer have been satisfied or waived, Fairfax, through Bid Sub, may electa stock ownership policy for senior employees as described in its sole“Executive Compensation — Compensation Discussion and absolute discretion to reduce the 90% threshold to 662/3%); (v) receipt of governmental consents and approvals required to consummate the transactions; and (vi) other customary conditions set forth in the Merger Agreement. The obligation of each party to consummate the transactions is also conditioned upon the other party’s representations and warranties being true and correct and the other party having performed in all material respects its obligations under the Merger Agreement.Analysis — Stock Ownership Policy.”

The Merger Agreement provides for certain payments upon termination of the Merger Agreement under specified circumstances. If the Merger Agreement is terminated by Allied World or Fairfax as a result of an adverse change in the recommendation of the other party’s board of directors, Allied World may be required to pay to Fairfax, or Fairfax may be required to pay to Allied World, a termination fee of $196 million.

Shareholders should be aware that a vote in favor of any of these proposals, including the Amendment Proposal and the Special Dividend Proposal, is not a vote in favor of, or a tender of our common shares into, the offer. The offer has not commenced. At the time the offer is commenced, Fairfax will file with the SEC: (i) a registration statement on Form F-4, which will include a prospectus of Fairfax in respect of the Fairfax shares to be issued in the offer; and (ii) a tender offer statement on Schedule TO (together with related documents, including an offer to exchange and a related form of letter of transmittal), and Allied World will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the offer. These documents will contain important information about the offer that should be read carefully before any decision is made with respect to the offer. By voting on the proposals in this proxy statement, you are not making a decision with respect to the offer. You will have the opportunity to elect whether to tender your shares in the offer at a later date once the offer is commenced.

For a more complete description of the Merger Agreement and the transactions contemplated thereby, see our Current Report on Form 8-K filed on December 20, 2016 with the SEC (including the complete text of the Merger Agreement, which is attached as Exhibit 2.1 thereto).

-10--25-

| PROPOSAL |

Pursuant to Swiss law, the Merger Agreement,Chairman of the companyBoard must be elected annually by our shareholders. The Nominating & Corporate Governance Committee has agreedrecommended electing Scott A. Carmilani to submit a proposalserve as Chairman of the Board until the Annual Shareholder Meeting in 2018. Mr. Carmilani has served as Chairman of the Board since January 2008. As noted in “Board Leadership Structure,” our rationale for combining the CEO and Chairman of the Board positions relates principally to the company’sBoard’s belief that at this stage of our development, we and our shareholders will be best served if the Chairman is in close proximity to amend Article 14the senior management team on a regular and continual basis. Under Mr. Carmilani’s leadership as President, CEO and Chairman of the ArticlesBoard, we have achieved considerable growth by expanding our business in Asia, Europe, Latin America and North America; have successfully responded to changes in the insurance and reinsurance industry as well as macroeconomic change; and have delivered superior value creation over the past several years. For additional information about our financial performance and our performance relative to our peers, please see the “Proxy Statement Summary” on page 1 of Association to permitthis Proxy Statement.

This proposal may only be approved if our shareholders voting (in person or by proxy) at the Annual Shareholder Meeting first elect Mr. Carmilani as a holderdirector in Proposal 1 — “Elect the Board of 10% or moreDirectors”. If our shareholders do not approve this proposal, the Board may call an extraordinary general meeting of our common shares to register its common sharesshareholders for reconsideration of this proposal.

Your Board unanimously recommends a vote FOR the nominee for Chairman of the Board, Mr. Scott A. Carmilani, as listed on the company’s shareholder register with full voting rightsenclosed proxy card. It is not expected that Mr. Carmilani will become unavailable for all shares held by such holder (or any of its affiliates or controlled personselection as defined in Article 14Chairman of the Articles of Association). The Board proposes thatbut, if he should become unavailable prior to the shareholders amend Article 14 of the Articles of Association so that subparagraphs b), c), e) and f)meeting, proxies will be deleted and not replaced and amend certain subparagraphs of Article 8 ofvoted in accordance with the Articles of Association that refer to subparagraphs b), c), e) and f) of Article 14 ofgeneral instructions provided on the Articles of Association. These amendments will provide assurance to Fairfax that Bid Sub or any other Fairfax-controlled company that holds common shares will, subject to and immediately upon the closing of the offer, be registered as a shareholder of Allied Worldproxy card with voting rights for all shares acquired in the offer or otherwise held by it. Under the current Articles of Association, holders of “controlled shares” that constitute 10% or more of our issued common shares have limited voting rights with respectregard to such “controlled shares”. Such voting right is limited, inother person as your Board shall recommend and nominate. In the aggregate, to a voting powerabsence of approximately 10% pursuant to a formula specified in Article 14 of the Articles of Association. The Articles of Association define “controlled shares” generally to include all common shares directly, indirectly or constructively owned or beneficially owned by any person or group of persons.other specific instructions, proxies will be voted as your Board shall recommend.

Pursuant to Swiss law, we are requiredthe Compensation Committee members must be elected annually by our shareholders. The Nominating & Corporate Governance Committee has recommended electing Mses. Alexander and Luck, and Messrs. Friedman, de Saint-Aignan, Schwartz and Weinhoff to submitserve as members of the Compensation Committee until the Annual Shareholder Meeting in 2018. As noted in “Nominees for Election — Board and Committee Membership,” the Compensation Committee is comprised entirely of independent directors. As noted in “Board Leadership Structure,” the Compensation Committee has the authority to you for your approval bothestablish compensation policies and recommend compensation programs to the English version and the (authoritative) German versionBoard. Each of the proposed amendmentsmembers currently serves on the Compensation Committee.

This proposal may only be approved if our shareholders voting (in person or by proxy) at the Annual Shareholder Meeting elect each of the directors that are members of the Compensation Committee in Proposal 1 — “Elect the Board of Directors”. If a director is not re-elected as a director in Proposal 1, he or she will be ineligible to serve on the Compensation Committee. If our shareholders do not approve this proposal, the Board may call an extraordinary general meeting of shareholders for reconsideration of this proposal.

Your Board unanimously recommends a vote FOR each of the nominees of the Compensation Committee, Mses. Alexander and Luck, and Messrs. Friedman, de Saint-Aignan, Schwartz and Weinhoff,

-26-

as listed on the enclosed proxy card. It is not expected that any nominee will become unavailable for election as a member of the Compensation Committee but, if any nominee should become unavailable prior to the Articles of Association. Upon the approval of this proposal, Articles 8 and 14 of the Articles of Associationmeeting, proxies will be amendedvoted in accordance with the general instructions provided on the proxy card with regard to readsuch other person as follows:your Board shall recommend and nominate. In the absence of other specific instructions, proxies will be voted as your Board shall recommend.

-11-

-12-

-13-

-14-

-15-

-16-

-17-

-18-

-19-

-20-

This proposal is conditioned uponPursuant to Swiss law, the closingindependent proxy must be elected annually by our shareholders. The Board has recommended electing Buis Buergi AG, a Swiss law firm, to serve as the independent proxy at and until the conclusion of the offer, which is also subject to other conditions. Please see “Recent Developments: Merger Agreement with Fairfax”Annual Shareholder Meeting in this2018. Mr. Paul Buergi of Buis Buergi AG has served as independent proxy statement for further discussion of the conditions to the closing of the offer.at our Annual Shareholder Meetings since 2012.

The vote on the Amendment Proposal is a vote separate and apart from the vote to approve the Special Dividend Proposal. Accordingly, you may vote to approve the Amendment Proposal and vote not to approve the Special Dividend Proposal or vice versa. The Amendment Proposal will only be implemented after each of the conditions to the offer as set forth in the Merger Agreement is satisfied or waived, and immediately prior to when the common shares are exchanged pursuant to the offer. The approval of the Amendment Proposal is a condition to the consummation of the offer. If the Amendment Proposal is not approved, the offer will not be consummated, and consequently, the Special Dividend Proposal, even if approved, will not be implemented. If the shareholders do not approve this proposal, the Board may call another specialan extraordinary general meeting of shareholders for reconsideration of this proposal.

The approval of the above amendments to Articles 8 and 14 of the Articles of Association requires the affirmative vote of at least two thirds of the votes represented at the Special Shareholder Meeting and a majority of the par value of our common shares represented at such meeting, where two or more persons are present in person and representing in person or by proxy at least 50% of our total issued and outstanding common shares.

Your Board unanimously recommends a vote FOR Buis Buergi AG as the amendment of Articles 8independent proxy at and 14until the conclusion of the Articles of Association as described in this proposal.2018 Annual Shareholder Meeting.

-21-

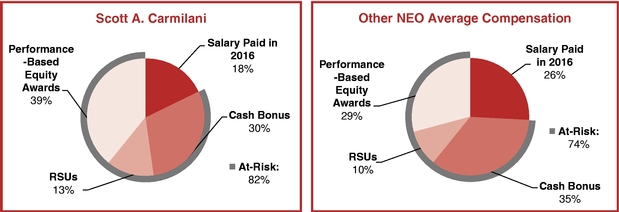

As required under U.S. securities laws, the company is providing its shareholders with the opportunity to cast an advisory vote on executive compensation as described below. The company believes that it is appropriate to seek the views of shareholders on the design and effectiveness of the company’s executive compensation programs.

The objectives of the company’s executive compensation programs are to attract and retain talented and highly-skilled employees, reward strong company and individual performance, align the interests of the executive officers and the company’s shareholders and remain competitive with other insurance and reinsurance companies, particularly those with which the company competes for talent. The company believes that its executive compensation programs, which emphasize long-term, performance-based equity awards, a significant portion of which is “at risk” with vesting dependent on the company achieving certain performance targets, meet this objective and are strongly aligned with the long-term interests of its shareholders. The “Compensation Discussion and Analysis” section of this Proxy Statement beginning on page 37 describes the company’s executive compensation programs and the decisions made by the Compensation Committee in more detail.

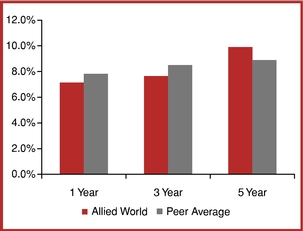

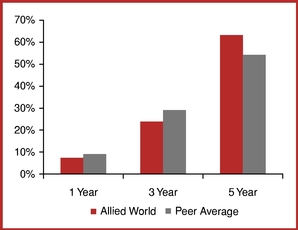

The table below reflects the company’s performance on a relative basis against its peer group of 12 insurance and reinsurance companies (the “Peer Group”) for the one-, three- and five-year periods ended December 31, 2016.

-27-

| Company’s Performance Relative to Its Peer Group as of December 31, 2016 (In quartiles. 1=first quartile, the highest level; 4=fourth quartile, the lowest level) |

Performance Metric | | 2016 (one year) Rank | | 2014-2016 (three year) Rank | | 2012-2016 (five year) Rank | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Diluted Book Value per Share Growth (adjusted for dividends) | | | 3 | | | | 3 | | | | 2 | | | |||

| Annualized Net Income Return ROAE (adjusted for other comprehensive income) | | | 3 | | | | 4 | | | | 2 | | | |||

| Combined Ratio | | | 3 | | | | 3 | | | | 2 | | | |||

| Total Shareholder Return | | | 1 | | | | 3 | | | | 1 | | | |||

Your Board unanimously recommends the approval of the following resolution:

RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K promulgated by the SEC, including the Compensation Discussion and Analysis section, compensation tables and narrative discussion, be, and hereby is, APPROVED.

As an advisory vote, this proposal is not binding upon the company. However, the Compensation Committee, which is responsible for designing and administering the company’s executive compensation programs, values the opinions expressed by shareholders in their vote on this proposal and will continue to consider the outcome of the vote when making future compensation decisions for the named executive officers.

| PROPOSAL 6 ADVISORY VOTE ON FREQUENCY OF THE SHAREHOLDER VOTE ON EXECUTIVE COMPENSATION AS REQUIRED UNDER U.S. SECURITIES LAWS |

As required under U.S. securities laws, the company is providing its shareholders with the opportunity to cast an advisory vote on the frequency with which the company should hold future advisory votes on the compensation of the company’s named executive officers. Shareholders may vote to hold an advisory vote on named executive officer compensation every year, every two years or every three years. The frequency vote must be held at least once every six years. Consistent with the results of the advisory vote on the frequency of the shareholder vote on named executive officer compensation at the company’s 2011 Annual Shareholder Meeting, the company has presented a proposal for an advisory vote on named executive officer compensation to shareholders each year since 2011.

The Board believes that an annual advisory vote on executive compensation will give the company’s shareholders the best opportunity to provide the company with direct input each year on the company’s compensation philosophy, policies and practices as disclosed in this Proxy Statement. Therefore, the Board recommends that shareholders vote to hold future advisory votes on the compensation of the company’s named executive officers every year. Although the shareholder vote on the frequency of advisory votes on named executive officer compensation is not binding on the Board or the company, the Board and the Compensation Committee will review the results of the vote and take them into consideration in determining how frequently to hold future advisory votes on named executive officer compensation.

-28-

If the exchange offer in connection with the proposed acquisition transaction by Fairfax is completed and, to the extent permitted under applicable law and regulations, the delisting and deregistration of the company’s common shares occur, the company would no longer be subject to certain reporting obligations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including the SEC rules requiring an advisory vote on the compensation of the company’s named executive officers, regardless of the vote results of this proposal.

Your Board unanimously recommends that shareholders vote to hold future advisory votes on executive compensation EVERY YEAR.

| PROPOSAL 7 APPROVE THE 2016 ANNUAL REPORT AND |

The 2016 Annual Report, which accompanies this Proxy Statement, contains our audited consolidated financial statements and our audited statutory financial statements prepared in accordance with Swiss law for the year ended December 31, 2016, as well as the reports of Deloitte & Touche LLP and Deloitte AG, our independent and statutory auditors, respectively. The 2016 Annual Report also contains information on our business activities and our business and financial condition. Pursuant to Swiss law, the Merger Agreement,2016 Annual Report, our audited consolidated financial statements and our audited Swiss statutory financial statements must be submitted to shareholders for approval at the company has agreed to submit a proposal to the company’s shareholders to approve the declaration and paymentAnnual Shareholder Meeting. The 2016 Annual Report will be available for physical inspection at our offices at Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland. Representatives of a special dividend of $5.00 per common share, payable, without interest, as soon as possible after such time that our common shares tendered pursuant to the offer are accepted for exchange by Bid Sub, to the holders of record of our outstanding common shares as of immediately prior to the Acceptance Time. The Board proposes that the shareholders approve the special dividend in the form of a distribution out of the general legal reserve from capital contributions. A report from our statutory auditor, Deloitte AG will attend the Annual Shareholder Meeting and will have an opportunity to make a statement if they wish. They will also be available to answer questions at the Special Shareholder Meeting to confirm that the payment of the special dividend will be in accordance with the Swiss law and our Articles of Association, subject to the completion of the required audit procedures. The special dividend amount of $5.00 per common share, which is approximately equal to CHF [ · ] per share using the USD/CHF currency exchange rate as reported by the Wall Street Journal on February 21, 2017, will be paid in U.S. dollars.meeting.